What’s misleading about this marketing tactic is that they are leading you to believe that the premium is level or won’t change for the policy’s life. If you review the fine print, you will see that it says “ affordable rates that increase over time.”ĪARP market their term life insurance as a level term benefit. If you bought a level term life insurance from AARP, I suggest you read the “fine print.” The second reason you need to be worried about AARP life insurance is that their level term life insurance increases in price every five years. Reason – Level Term Life Insurance Increase In Price Every 5 Years You can buy up to $50,000 coverage without a medical exam. Permanent life insurance is available to AARP members who are 50 to 80 years old. You can qualify for coverage without undergoing a medical exam. Term life insurance is available to members who are 50 to 74 years old. There are two types of AARP life insurance available: term life insurance and permanent life insurance. This is the one important requirement you cannot escape.ĪARP members, ages 50 through 79, can buy life insurance. You need to be an AARP member to buy life insurance.

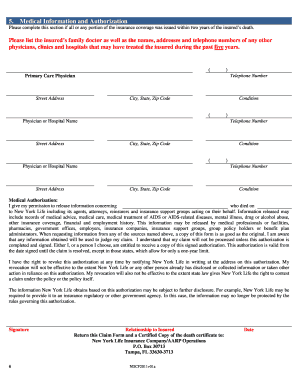

New York Life provides all life insurance policies acquired through AARP. AARP only serves as the marketing arm of New York Life. It’s an open secret that AARP endorses life insurance companies that give them the most benefits. The term and whole life insurance policies sold to senior members over 50 with no medical exam are actually underwritten by New York Life.ĪARP has been endorsing New York Life since 2011. The organization does not provide AARP insurance products. Don’t be misled AARP is not an insurance company. The first reason you should be worried about AARP life insurance is that AARP is not even an insurance company to begin with.ĪARP is a popular organization selling life insurance for seniors. Reason #1 – AARP Is Not An Insurance Company REASON #5 – It Has a Two-year Waiting Period.REASON #4 – You Need to Be In Great Health to Qualify.REASON #2 – Level Term Life Insurance Increase in Price Every 5 Years.REASON #1 – AARP Is Not an Insurance Company.In this article, we will go over the different reasons why you should be worried about AARP life insurance. This article will answer your questions if you want more information on AARP life insurance products for yourself or your parents.

Most seniors can find better insurance options with other life insurance companies, so it is best to compare products and quotes before buying a policy. Do you have AARP life insurance? Are you considering purchasing an AARP life insurance?ĪARP is branded as an advocacy group for seniors lobbying for seniors’ rights however, this senior rights protector’s claim may let you think they have the best life insurance plans.

0 kommentar(er)

0 kommentar(er)